Stop Gambling in the Stock Market. Be an intelligent and confident investor.

See what the professionals see with financial analytics, charts and valuation models.

Fundamental Analysis and Stock Valuation Simplified. Learn more.

See what the professionals see with financial analytics, charts and valuation models.

Fundamental Analysis and Stock Valuation Simplified. Learn more.

A Pharma company is undervalued right now just like Divis Labs.

05-Jan-2017

Back in June 2017 we talked about Pharma companies being undervalued even though the Nifty PE ratio was 25 at that time. Some of the biggest names in India pharma had taken a severe beating. We had kept couple of Pharma companies on our radar and were monitoring them to see if they reach below their fair value, we will talk about two of those Pharma companies today.

In December 2016 Divis labs stock price had crashed from around 1200 Rs to 700 Rs because the US FDA issued warnings about the manufacturing process in some of its plants. When market panics, we start buying because we believed that Divis would fix these issues and get the green signal from US FDA. We also noticed that in the NSE Insider Trading emails we send to our professional members the executive director of Divis (Madhusudana Rao Divi) was buying huge amount of stock as well. It is a good sign when the insiders are buying stock when the share price is undervalued.

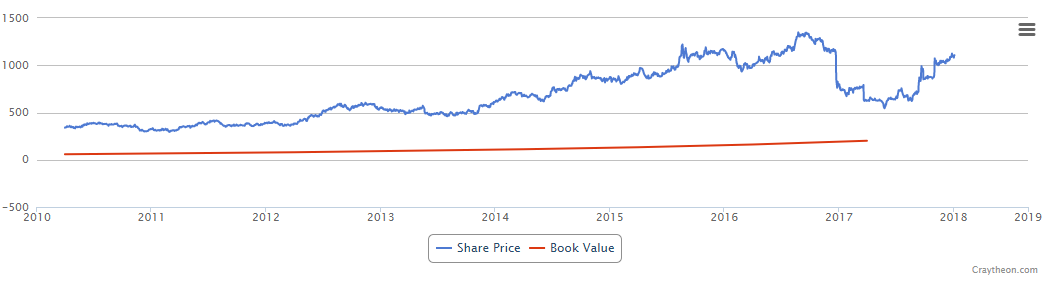

Divis Share Price Chart

The stock price was ticking up slowly in the next few months, we were happy with our decision and then came another bad news. The US FDA declared an import alert on some drugs which meant those drugs could not be sold in the US, the share immediately crashed again. Now the intelligent investor in such scenario instead of panicking remains calm and looks at the facts. The company said it would work with consultants and US FDA to solve the second problem as well, so we bought some more stock. The share price reached a record low of 543 Rs in May 2017 with a PE of 13, the average PE was 25.

Such irrational behaviour by the market should be welcomed. Investors who bought the stock then would have been rewarded with 100% + return in less than a year.

There is a similar opportunity with another Pharma company, professional members who get our Valuation Screener Alert would probably know the name of the company.

Disclaimer - Long Divis. The information provided in this article does not constitute buy or sell recommendation.

Published - 05-Jan-2018