Stop Gambling in the Stock Market. Be an intelligent and confident investor.

See what the professionals see with financial analytics, charts and valuation models.

Fundamental Analysis and Stock Valuation Simplified. Learn more.

See what the professionals see with financial analytics, charts and valuation models.

Fundamental Analysis and Stock Valuation Simplified. Learn more.

NSE Nifty P/E, P/B, Chart

Nifty PE Ratio

Current Nifty PE Ratio on 31-Mar-2023 is 20.44. ( Long term average is ___. Sign up for premium membership to see the long term historical Nifty PE average.)

Nifty PE ratio measures the average PE ratio of the Nifty 50 companies covered by the Nifty Index. PE ratio is also known as "price multiple" or "earnings multiple". If P/E is 15, it means Nifty is 15 times its earnings. Nifty is considered to be in oversold range when Nifty PE value is below 14 and it's considered to be in overvalued range when Nifty PE is near or above 22. The market quickly bounces back from the oversold region because intelligent investors start buying stocks looking to snatch up bargains and they do the exact opposite when Nifty P/E is in the overbought region.

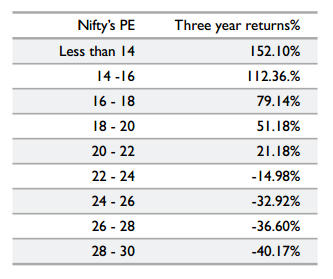

Check out what Professor Bakshi (a famous Indian value investor ) has to say about Nifty P/E. Recent research done by my firm shows just how dangerous it is to remain invested in an expensive market. Since NSE started, every time when Nifty's Price/Earnings ratio exceeded 22, the average return from Indian equities over the subsequent three years became negative.

Source - sanjaybakshi.net

History clearly tells us that if you are a passive long term investor you should buy stocks when P/E reaches 15-16 and stop buying when P/E goes above 22. If you are not comfortable buying individual stocks then you should buy Nifty Bees ETF. Nifty Bees is like a mutual fund which tracks the NSE Nifty Index.

Sign up for premium service to see 15 year Nifty PE and the long term historical Nifty PE average

Nifty Price Book Ratio, Dividend Yield

Nifty P/B Ratio is 4.05 on 31-Mar-2023. Dividend Yield is 1.44 on 31-Mar-2023.

Nifty is considered to be in oversold range when Nifty P/B ratio is below 2.5 and it's considered to be in overbought range when Nifty P/B is near 4. Dividend yield generally bounces between 1 and 1.5. A dividend yield above 1.5 means its a good time to buy.

A long term investor should buy Nifty Bees as well as individual stocks when P/B ratio is near 2.5 to get maximum return from stock market. This is the point where Nifty is lowest which of course means that the so called "stock market gurus" on TV would be screaming gloom and doom messages about the world when the index reaches its lowest level.

To know more about intelligent investing - How to be an intelligent investor.